This datasheet explores how our mobile banking system ensures a seamless and secure mobile banking experience, allowing your customers to effectively manage their finances anytime, anywhere. The document shows how the system facilitates financial transactions, enhances user experience, and encourages a functional modern mobile banking system for your financial institution.

Delivering Seamless Banking Anywhere, Anytime

Reimagine your customers’ banking experience

The trend toward digital banking and the convenience of mobile banking is on the rise. More and more people are now using their mobile devices for financial transactions. This shift in consumer preference toward mobile banking across all market segments is making it possible for Financial institutions like yours to increase their number of tech-savvy clients to spur innovation and attain customer centricity.

Therefore, you must attempt to up with innovation to provide your customers a solution that is simple, practical, and seamless across all protected channels.

About Mobile Banking Solution

TERA Mobile provides your customers with an easy-to-use and secure banking experience. The solution provides ‘direct app update’ functionality for quick app deployment on both Android and iOS.

With this solution, you can assist your customers throughout their entire banking experience, from account opening to transactional banking demands, on their preferred mobile devices.

With this solution, you can assist your customers throughout their entire banking experience, from account opening to transactional banking demands, on their preferred mobile devices.

The solution has a wide range of access methods help you cater to the various demands of your customers. Moreover, Tera Mobile effortlessly connects with your various corporate systems to provide genuine cross-channel capabilities by utilizing our exclusive omnichannel hub.

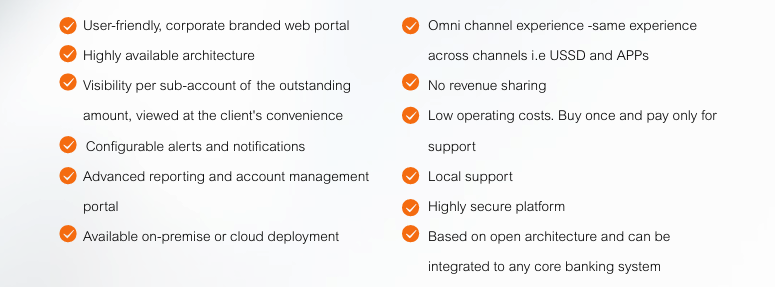

Business Benefits You Get from Tera Mobile

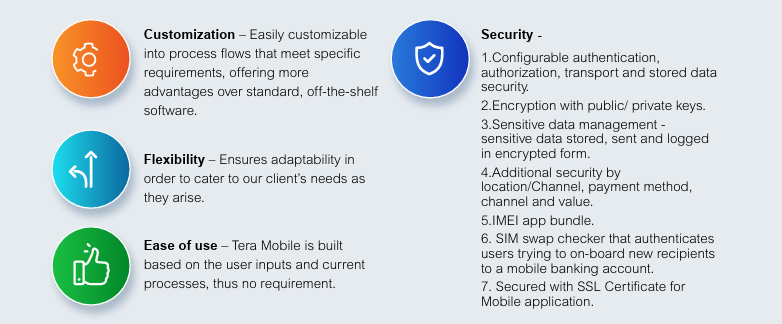

Key Mobile Banking Features

Functional Modules of Tera Mobile

Administrator

- Customer Registration

Allows for auto onboarding or activation of new members - Reporting

An interface for generation of reports and dashboard functions

Account enquiries

- Virtual Registration (Users validated using IPRS data)

- Balance Enquiry

- Mini statement

- Mobile Loan Balance

Bill Payments

For utility and other service bill payments through mobile phones.

Credit Scoring

- Uses several mechanisms to rate the scores of borrowers.

- Integrated with CRB, i.e., Metropol, Transunion, etc.

- Has an internal KYC process that facilitates credit scoring dynamically using internally

available information.

Money Transfer

Allows customers to transfer funds to the following:

- Own accounts

- Other accounts

- To and from third parties e.g. Mobile Money Mpesa

- Transfer to Bank

Airtime Purchase

- Allows customers to purchase airtime from their local mobile network operators.

- Customers can also purchase airtime for another mobile number in addition to their own.

Deposit

- Deposit from MPESA-STK PUSH

Customer Alerts and notifications

- Alerts sent out after successful completion of transactions.

- Alerts engine integrated to SMS gateway.

- Alerts sent in SMS for the following services:

- Welcome SMS notification upon account opening

- Debit card collect SMS notification upon receipt of debit card order

- PIN mailer collect notification

- Happy birthday notification

- Loan approval and disbursement notification

- Loan decline notification

- Account Activity Alerts – Debit transactions

- Account Activity Alerts – Credit transaction

Back to Datasheets Page