TERA MOBILE

Next-Gen Mobile Banking Solution

Empower your customers with our robust, secure, and scalable mobile banking solution. Stay competitive, meet tech-savvy customer needs effortlessly. Elevate banking experiences today!

Mobile Banking Made Simple

Bring convenience and accessibility to your customers’ fingertips. Make mobile banking not just convenient but incredibly simple:

- Ease of use

- Tailor to match your institution’s branding

- Personalize the user experience for your customers.

- Easily accommodate a growing number of users and increasing transaction volumes without compromising performance or functionality.

- Robust security measures (e.g., encryption, multi-factor authentication, fraud detection, etc.).

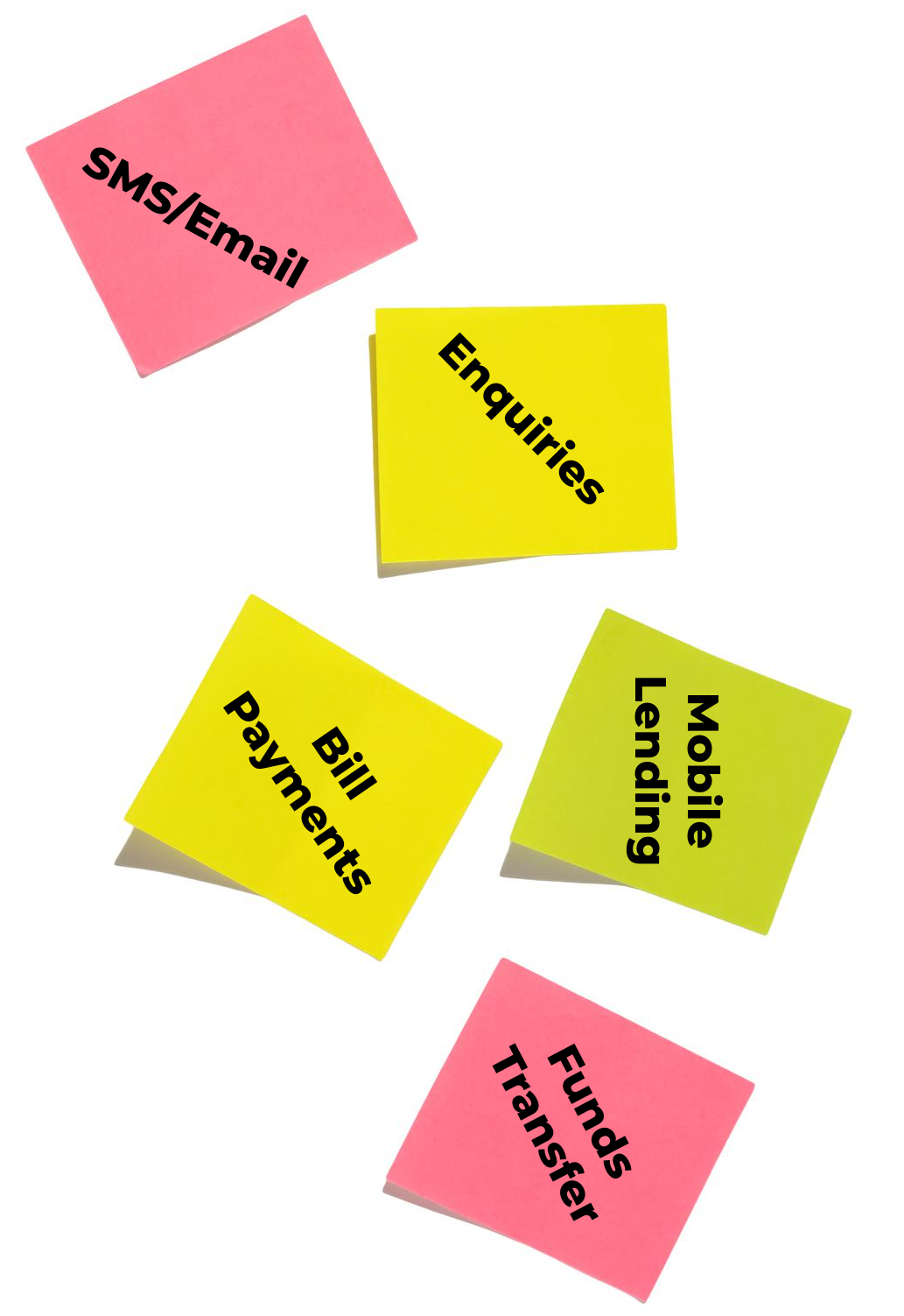

Everything Your Customers Can do with Our Mobile Banking Solution

Our mobile banking solution offers your customers a comprehensive range of features and functionalities:

Enquiries

- Balance Enquiry

- Mini-statement

- Forex rates

- Loan Balance

- Transaction history

Bill payments

- KPLC

- GOTV

- DSTV

- ZUKU

- Star Times

Funds Transfer

- Mobile money / wallet to account

- Account to mobile money

- Account to Account

- MVisa

- Pesalink by K3A

Mobile Lending

- Agri lending

- Micro Loans

SMS/Email

- Debit transactions

- Credit transactions

ADMINISTRATION MODULE

- Customer

- Registration

- Customer Profile

- Management

- MIS Reporting

We aim to cover all aspects of banking services that help you enhance customer satisfaction.

Group Lending Financial Model

Provide your customers with a solution that enables them to form lending groups, define their roles, apply for a loan, and repay the loan.

- Group Formation

- Loan Application

- Loan Approval and Disbursement

- Repayment Management

- Group Performance Monitoring

Key Use Cases for Your Banking Services

- Sacco Level

- Account Management: Members can view their account balances, transaction history, and statements.

- Savings and Investments: Members can deposit funds, create savings accounts, and manage investment portfolios.

- Loans and Repayments: Members can apply for loans, track loan status, and make loan repayments.

- Bill Payments: Members can pay bills, utilities, and subscriptions directly from their mobile devices.

- Group Lending: Members can form lending groups, apply for group loans, and manage group loan repayments.

- Bank Level

- Account Services: Customers can access and manage their bank accounts, perform transactions, and view statements.

- Payments and Transfers: Customers can make payments, transfer funds between accounts, and initiate domestic and international transfers.

- Card Management: Customers can activate, block, or replace their debit or credit cards through the mobile app.

- Bill Payments: Customers can pay bills, utilities, and subscriptions directly from their mobile devices.

- Loan Applications: Customers can apply for loans, track loan status, and make loan repayments.

- Microfinance Banks Level

- Group Lending: Customers can form lending groups, apply for group loans, and manage group loan repayments.

- Savings and Deposits: Customers can open savings accounts, make deposits, and earn interest on their savings.

- Microinsurance: Customers can access microinsurance products and manage their insurance policies.

- Bill Payments: Customers can pay bills, utilities, and subscriptions directly from their mobile devices.

Mobile Banking Utilities Specification Per Country

Integration with major utility companies for seamless bill payments.

- Kenya

- Water bills: Nairobi Water and Sewerage Company

- TV and internet bills: Zuku, Safaricom Home Fibre

- Mobile network bills: Safaricom, Airtel, Telkom

- DStv, GOTV, Star Times and Zuku TV subscriptions

- Nairobi County parking fees

- Electricity bills: KPLC token purchase for prepaid electricity

- Tanzania

- Electricity bills (e.g., TANESCO)

- Water bills (e.g., Dawasco)

- TV and internet bills (e.g., Multichoice Tanzania, Zuku)

- Mobile network bills (e.g., Vodacom, Airtel, Tigo, MTN)

- DStv and Azam TV subscriptions, etc.

- TANESCO token purchase for prepaid electricity

- Government payments (e.g., taxes, fees)

- Uganda

- Electricity bills (e.g., Umeme)

- Water bills (e.g., National Water and Sewerage Corporation)

- TV and internet bills (e.g., DSTV, Zuku, Startimes)

- Mobile network bills (e.g., MTN, Airtel, Vodacom, Africell)

- URA (Uganda Revenue Authority) tax payments

- NWSC token purchase for prepaid water

- School fees payments (some schools accept mobile payments)

- Rwanda

- Electricity bills (e.g., Rwanda Energy Group)

- Water bills (e.g., WASAC)

- TV and internet bills (e.g., DSTV, Startimes, Liquid Telecom)

- Mobile network bills: MTN, Airtel, Vodacom, Tigo)

- RRA (Rwanda Revenue Authority) tax payments

- Tigo Cash and MTN Mobile Money bill payments

- Health insurance premiums (e.g., Mutuelle de Santé)

- Zanzibar

Integration with mobile money platforms: -

- Zantel Mobile Money

- Tigo Pesa

- Airtel Money

- Vodacom

- MTN

- Myanmar

- Electricity bills (e.g., Yangon Electricity Supply Corporation)

- Water bills (e.g., Yangon City Development Committee)

- TV and internet bills (e.g., Skynet, CANAL+)

- Mobile network bills (e.g., MPT, Telenor, Ooredoo, My Money, Wave Money)

- Tax payments (e.g., Internal Revenue Department)

- Ooredoo Money and Wave Money bill payments

- Top-up mobile airtime for various networks

Optimal Practices We Adhere to

We adhere to the highest industry standards to ensure a secure and reliable solution. We prioritize:

-

- Data encryption

- Multi-factor authentication

- Secure APIs

- Rigorous security audits

Etc.

To Protect Your Customers’ Information

Our solution is designed to comply with regulatory requirements, providing your customers a safe environment for banking transactions.

Benefits your Business will Secure with Our Mobile Banking Solution

By implementing our mobile banking solution, your business can reap numerous benefits, including:

- Increased Customer Engagement by up to 60% through seamless access to your essential banking services.

- Witness a remarkable 40% expansion in market reach by successfully tapping into a wider customer base that favors the convenience of digital banking channels.

- Experience substantial cost savings of up to 25%. No physical branches or manual processes. Optimize operational expenses for your institution.

- Set your institution apart from competitors. Achieve a competitive edge with a notable 50% higher customer acquisition rate with our comprehensive and user-friendly mobile banking solution.

Revolutionize Your Mobile banking services!

Elevate customer experience with Tera Mobile. Empower your institution’s future in digital banking.

Contact us today!