This datasheet contains detailed information on the Credit Management System, including loan application processing, risk assessment, loan approval operations, and ongoing loan monitoring. This datasheet shows you how the system increases efficiency in managing the loan process, and decision.

You’re just one step away from making your lending processes more accurate and effective.

Key Highlights of Credit Management System

Process Overview

The most essential feature of Tera CMS is the Loan Application Processing Workflow. Each loan application is monitored from the time it is entered into the system, and tracked through the various work steps of credit review and approval process.

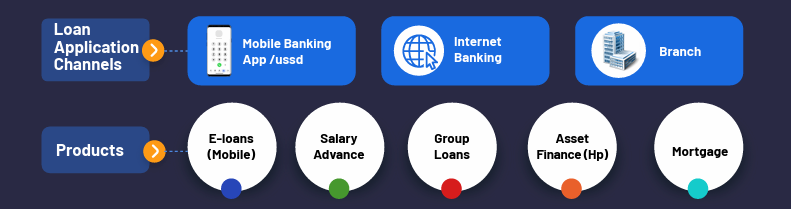

Loan Origination System (LOS) provides you an end-to-end approach to your loan origination, with a holistic approach during the entire loan life cycle. The system provides you a structured workflow and supports your multiple loan products with different origination channels.

The system allows these workflows to be performed in different locations/offices while maintaining control of the flow and ensuring no critical steps are bypassed.

The solution easily integrates with your other existing systems, offering you a robust credit scoring engine and archiving for various loan application related documents. Moreover, TERA CMS considers credit scores from third party scoring agencies and enables you as the originator to input such details under credit score details along with comments. You can also parametrize credit scores where you only have to input credit scores, and the system determines the ratings.

THE NLS CREDIT MANAGEMENT SYSTEM

Modules of Credit Management System

Core Processes

Back to top