TERAFIN

The Ultimate API Integration Hub and Business Continuity Solution for Your Bank

Channel Manager is a powerful channels software specifically tailored to ensure that your customer digital channels are available 24/7. It’s a cutting-edge Channel Integration Platform that streamlines your financial services and serves as a central hub for API integration, ensuring the highest levels of business continuity and customer satisfaction.

Terafin is the result of Our Over 10 years of experience in providing modern banking solutions.

The system increases the productivity of your digital banking channels, like online banking, mobile banking, ATM, Cheques Posting, Agency Banking, etc., during downtime, slowness or unresponsiveness. Your channels are NOT affected.

It provides you with the possibility of providing new services on your channels at the highest possible speed, performance and uptime with quick to market deployments while providing modern banking services to enable your institution have a competitive edge.

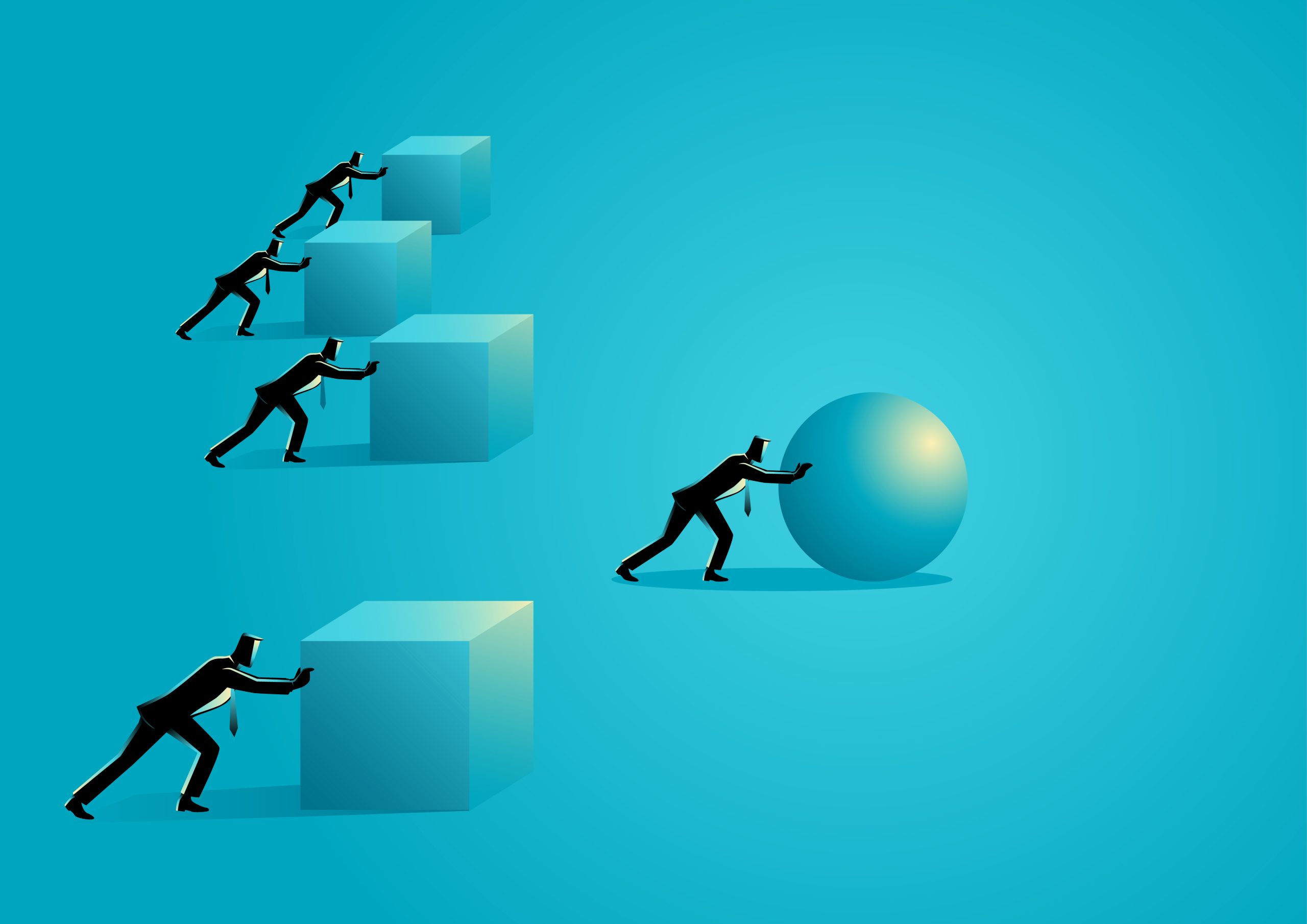

In the Absence of Terafin, Your Bank Struggles with These 3 Major Challenges

- Inflexibility

Brought about by your old technologies and single purpose designs. This can hinder your ability to adapt quickly to evolving customer needs and market trends. And if you’re using an Enterprise Service Bus (ESB), your inherent complexities are more challenging — ESB only solves your business continuity needs. - Operational Inefficiencies

Manually handling digital transactions and managing channels is time-consuming, error-prone, and often requires significant manual effort. This leads to operational inefficiencies and delays in customer service brought about by core downtimes, slowness, unresponsiveness, failures due to changes and patches, end of day processing, reporting resource hogging affecting channels, etc. - Increased Risk Exposure

Your digital banking channels are susceptible to various risks, i.e., fraud and money laundering. Without a robust risk management system, your team may struggle to detect and prevent fraudulent activities in real-time. The result? Financial losses, reputational damage, and non-compliance with regulatory requirements.

This is where Terafin Comes into Play: Your Integration Hub

- One-stop Solution

Consolidates all your API integrations into a single, easy-to-manage platform. - Simplified Management

A unified interface makes it easy to monitor, maintain, and optimize your API integrations. - Enhanced Security

Ensures secure data exchange between your services and third-party APIs. - Enhanced Scalability

Reduces the processing burden on your core system to enable it accommodate increased transaction volumes without impacting system performance or experiencing service disruptions. - Increased Transaction Processing Capacity

Offloads channel transactions processing from your core system, significantly increasing its transaction processing capacity. This means the system can handle a larger volume of customer transactions, leading to improved efficiency and reduced processing times.

Terafin has benchmarked times of <100ms for enquiries and <200ms for transactions.

- Improved Cost-efficiency

Cuts cost by 60%. Unify all your Bank’s Data into One Modern Database Off your Core Banking System. By reducing the strain on your core system, you can optimize your infrastructure, potentially avoiding expensive hardware upgrades and reducing maintenance costs. Increasing the efficiency and scalability of your core system can enable you to handle higher transaction volumes without incurring additional expenses. - Enhanced Customer Satisfaction

With Terafin, you can maintain excellent customer service even during unexpected disruptions, resulting in improved customer trust and loyalty. - Improved System Response Times and Performance

Offloading financial processing capability frees up resources on your core system, enabling it to respond more quickly to other critical functions. Te result? Faster response times to customer inquiries, reduced latency in transaction processing, and improved overall system performance. - Enhanced Flexibility and Agility

Introduce new services, features, and updates more efficiently. This enables you to respond faster to market demands, regulatory changes, and customer expectations. - 24/7 Availability

Ensures 24/7 availability of your customer digital channels, independent of your core system. This eliminates potential disruptions and downtime, allowing your customers to access their accounts, perform transactions, and receive support at any time, enhancing customer loyalty and engagement. - Risk Mitigation

Incorporates a fraud and anti-money laundering detection module, which proactively monitors digital transactions and identifies suspicious activities in real-time. This helps you to detect and prevent fraudulent transactions, mitigate risks, protect customer assets, and comply with regulatory requirements.

Business Continuity in the Face of Your Core System’s Downtime

Your customer-facing channels remain operational even when your core system is down.

- Uninterrupted Service

- Reduced Downtime Impact

- Resilience and Reliability

Terafin’s is built for high availability, ensuring consistent performance and reliability.

How Channel Manager Typically Works

The system typically functions as an intermediary between your core banking system and your various customer-facing digital channels. Here is a high-level description of the flow:

- Customer Interaction

Your customers interact with your bank through different digital channels, such as online banking portals, mobile apps, ATMs, or even third-party platforms. - Channel Manager Interface

Channel Manager acts as a centralized hub that receives and processes your customers’ requests from these different channels. It provides a unified interface for managing the interactions across multiple channels. - Transaction Processing

Terafin processes the requested service or transaction based on the instructions received from the customer. This may involve locking funds, validating transactions, charges processing or performing any other required channel transaction processing operation on Terafin without calling core banking. - Feedback and Notifications

Once Terafin completes the requested service or transaction, it sends the response back to the respective customer channel, ensuring a seamless and consistent customer experience. - Sync and Uploads to the Core Banking System

The feedback generated is then transmitted from Terafin to your core system in near real-time asynchronously after your customer has been served. This transmission occurs through secure communication channels, e.g., secure APIs or message queues, to maintain data integrity and confidentiality. - Monitoring and Analytics

Terafin continuously monitors and captures data on customer interactions, channel performance, and transaction statistics. Your team can use this information for analytics, reporting, and optimizing your bank’s services and channels.

Building Blocks of Channel Manager

We offer every component required to deliver a high performing channel manager solution:

- Transaction Processing Engine

Processes requests and provides feedback on a complete transaction done fully on Terafin. - Sync Component

Lightweight, unintrusive data mirroring tool from core system to Terafin Database on real-time manner and less that 25% of the data. - Events and Notifications

For Terafin-based events. The module allows for email and SMS alerts. - Reconciliation Module

A reconciliation system for Terafin-processed transactions with the Core Banking module. - Dashboard

Monitor traffic and service status in real-time.

Unique Highlights of Our Channel Manager Solution

- Cloud and Microservices Ready

- Cheque Clearing APIs

- Loan APIs

- Payments APIs

- Bulk payments APIs

- Enquiries APIs

- Forex APIs

- Alerts and Notification APIs

- Over 178 APIs integrated

Best Standards We Follow

We are committed to adhering to the best industry standards when developing our Channel Manager Solution. Terafin incorporates robust security measures to protect sensitive customer data and ensure regulatory compliance. Furthermore, we follow industry-leading standards for data integration, customer segmentation, and performance monitoring, ensuring that our solution aligns with the latest advancements and best practices in the banking industry.

Transform Your Financial Services with Terafin

Contact us today for a personalized demonstration and discover how our solution can transform your institution’s integration strategy and operational resilience.