Reconciliation Solution (Ntellicheck)

Navigating Your Account Reconciliation Challenges

Ntellicheck is a comprehensive Account Reconciliation Solution designed to streamline and simplify the reconciliation process for you.

With multiple channel transactions, such as ATM withdrawals, online transfers, and debit card payments, financial records can quickly become fragmented and difficult to manage. This complexity can result in discrepancies between your records and those of your customers, leading to time-consuming and error-prone manual reconciliation processes.

Our reconciliation solution addresses such challenges head-on, providing you with a robust and efficient tool to ensure accurate and timely reconciliation.

Core Capabilities in Ntellicheck

- Seamless Integration: with your banking system without disrupting your existing operations.

- Automated Matching: of transactions between your account statements and internal records, reducing manual effort and minimizing errors.

- Exception Handling: Intelligently identifies and flags discrepancies, anomalies, and potential fraud, reducing financial risks.

- Real-time Data Sync for up-to-date reconciliation information.

- Customizable Rules and criteria to meet your specific needs.

- Data Validation for accuracy, ensuring the integrity of your financial information and regulatory compliance.

What Ntellicheck Actually Does for You

NTellicheck acts as a centralized platform that brings together disparate transaction data from various sources.

The solution:

- Automates the matching process

- Reconciles transactions

- Identifies discrepancies

- Facilitates exception handling.

And Many More.

Key Use Cases

- Account Reconciliation

Reconcile your bank statements with internal records. Ensure accuracy and accountability of all transactions. - Statement Reconciliation

Reconcile your statements against internal records for any inconsistencies. Facilitate timely corrections. - Fraud Detection

Detect potential fraudulent activities and take immediate action. - Compliance and Audit

Easily generate comprehensive reports and audit trails for regulatory compliance. - Transaction Matching

Effortlessly compare large volumes of transactions and reduce the risk of errors and discrepancies.

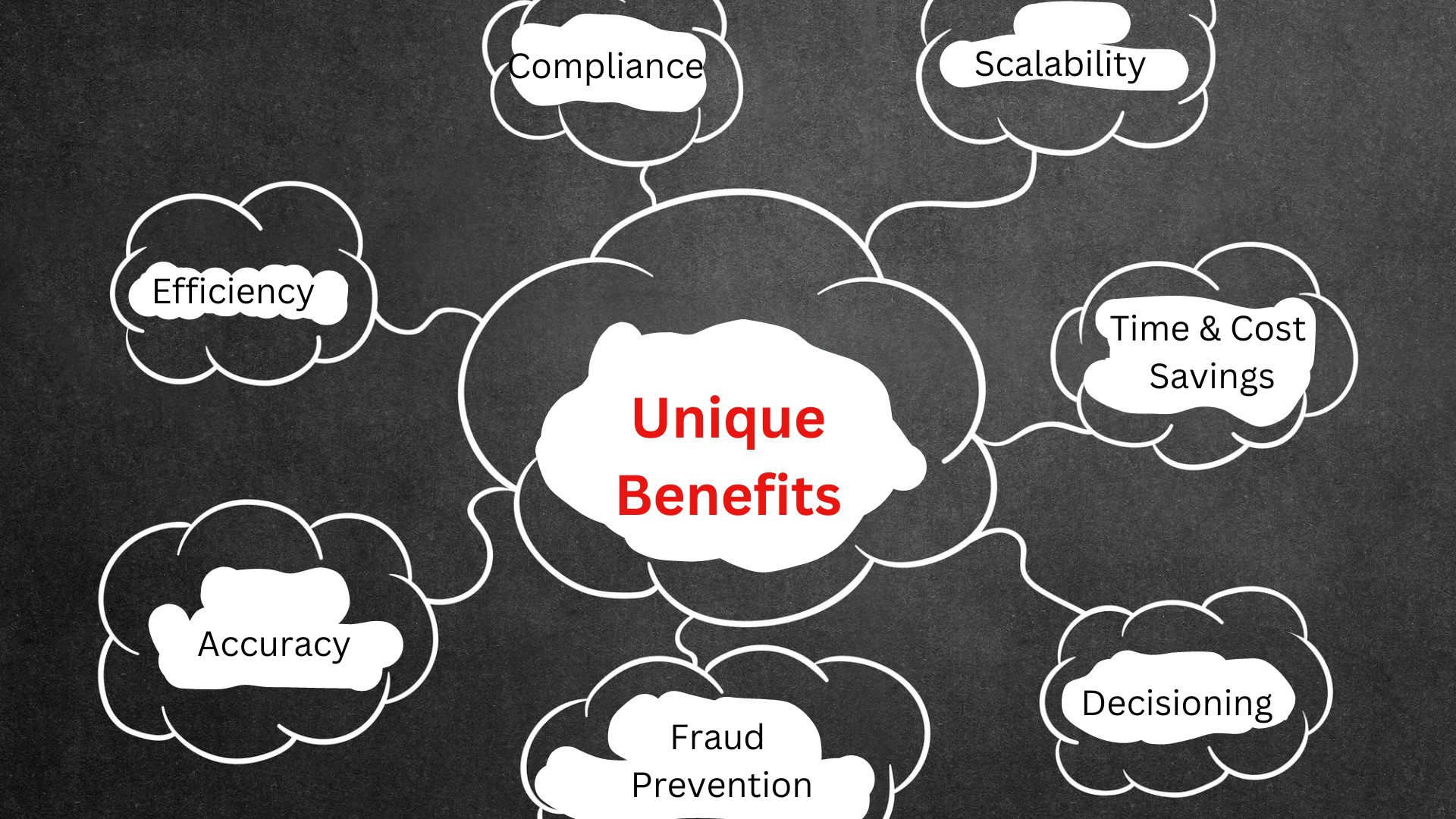

Discover the Benefits Embedded in our Reconciliation Solution

- Time and Cost Savings

Automate your manual reconciliation tasks. Reduce the cost, time, and effort required for the process. - Increased Accuracy

Leverage automation to minimize human errors. Ensure accurate and reliable reconciliation results. - Enhanced Efficiency

Complete your reconciliation tasks more quickly and allocate resources to strategic initiatives. Improve overall operational efficiency. - Fraud Prevention

Identify and mitigate potential fraudulent activities, safeguard customer accounts and your institution’s overall reputation. - Regulatory Compliance

Streamline your reporting to meet regulatory requirements and maintain proper audit trails.

Best Standards We Follow

We understand the critical nature of your banking operations and adhere to the highest standards to ensure our solution meets industry requirements:

- Security and Data Protection

We employ robust security measures to safeguard sensitive financial data, including encryption, access controls, and compliance with data protection regulations. - Industry Compliance

Our solution complies with international banking standards, such as ISO 20022 and SWIFT messaging, ensuring seamless integration and interoperability. - Scalability and Flexibility

Our solution is designed to scale with your growing transaction volumes and can be easily customized to align with your specific needs and processes.

Choose Ntellicheck to Transform Your Reconciliation Process

Learn how you can experience the efficiency, security, and innovation we’re talking about. Ntellicheck is your best choice.