Find details about our state-of-the-art solution designed to make the account reconciliation process easier and more efficient. This publication provides insight into key features such as automating reconciliation workflows, real-time data accuracy analysis, customizable reporting tools, and secure transaction tracking Discover how our account reconciliation process ensures accuracy, quality work efficiently and compliantly, providing robust solutions to settle simple financial transactions.

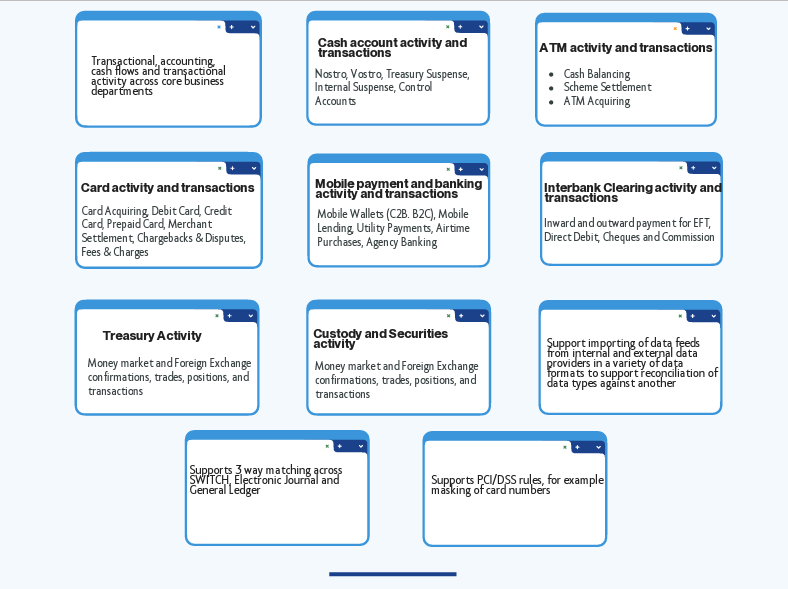

Account Reconciliation Interfaces

Key Account Reconciliation Features

- Configurable access rights to enhance security.

- Real-time matching and automation

- Integration with existing infrastructure

- Reports based on the reconciliation status for audit purposes

- Provision of manual reconciliation for unmatched items

- Review and reversal of matched transactions should incorrect references be made

- Allows reconciliations to be created for multiple banks, companies and environments

- Multi-currency, multi-site solution deployable on multiple environments

- Direct uploading of files not available to users in csv format Solution

- Built in email function to facilitate communication and notification

Components of Reconciliation Solution

Why Automate Your Account Reconciliation?

- More efficient operations and Improved Return on Investment by migrating all reconciliations onto the single strategic platform.

- Straight Through Processing from source data loading to Exception Management in the entire chain of reconciliation process and help in complying with all the mandated regulatory requirements.

- Its innovative ‘scale-out’ architecture used for the core reconciliation & optimization engine translates into significant reduction in costs, enabling maximum automation with near real-time reconciliations.

- Generic Platform to run all types of reconciliation processes and provides greater visibility into reconciliations and outstanding positions.

- Reduced operational risk by automating manual processes to enable exceptions based transaction lifecycle processing.

- Adaptable and extensible architecture for future needs.

- Provides a consolidated view of positions on all accounts.

Back to Datasheets