TERA CMS

TERA CMS Meets Head-On, Your Loan Origination & Processing Challenges

Such as cumbersome paperwork and manual approval processes. Delays become a thing of the past, replaced by instant approvals for digital loans and reduced turnaround times for other loans.

The benefits extend further. TERA CMS seamlessly integrates with your existing systems, introducing a robust credit scoring engine and an advanced archiving system for loan application-related documents.

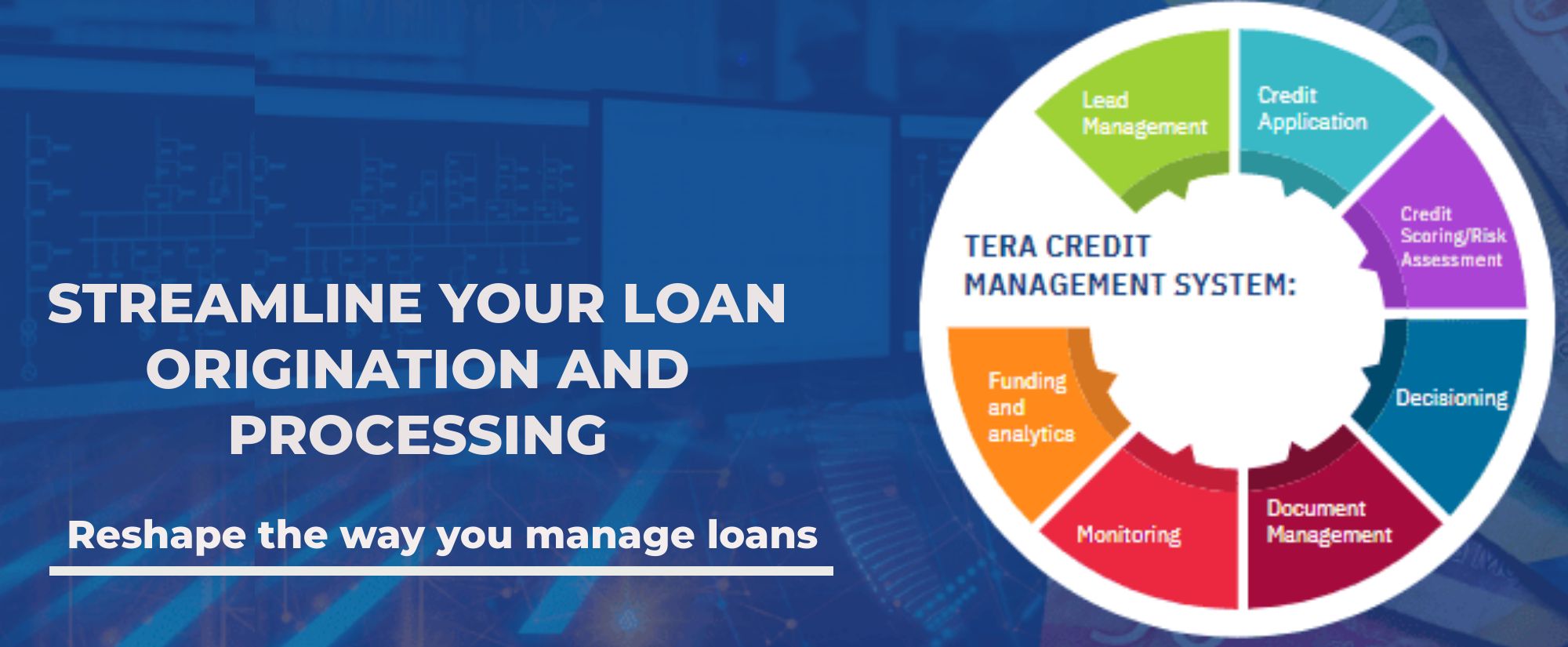

We Take a Holistic Approach

Our team of software engineers provides you an end-to-end solution that simplifies your loan origination and processing step by step, through advanced workflow technology. The system leverages advanced workflow technology to streamline loan origination and processing, reshaping the way you manage loans.

Moreover, the system considers credit scores from third party scoring agencies and provides a provision for you to input such details under credit score details along with comments on the same. Credit scores can also be parameterized where you only have to input credit scores, and the system determines the ratings.

Key Highlights of Our Credit Management System

- Reduce loan application and approval to less than 10Min

- Integrate to any Datasource DB, Excel, CSV, API

- Configurable Scorecard development and implementation

- Supports Risk based lending

- Reduce your Go to market to under a day

- Cloudy and Microservices ready

- Configurable Workflows Support

- Machine learning Powered platform

Tera CMS Supports Your Diverse Range of Loan Products and Origination Channels

Tera CMS adapts to your unique loan products and origination channels, offering you unparalleled flexibility.

Loan Application Channels

- Mobile Banking App /ussd

- Internet Banking

- Branch

Loan Products

- E-loans (Mobile)

- Salary Advance

- Group Loans (Chamas)

- Asset Finance (Hp)

- Mortgage

- SME Loans

- IPF (Insurance Premium Financing)

Credit Management System Modules

- Lead Management

- Loan Origination

- Decisioning

- Collateral Management

- Document Management

- Credit Scoring

- Collection

- Monitoring

Tera CMS Core Processes

- Credit Scoring Engine

- Analytics

- Administration

- Integrated Workflow Management

- Document Management

- Alerts and Notifications

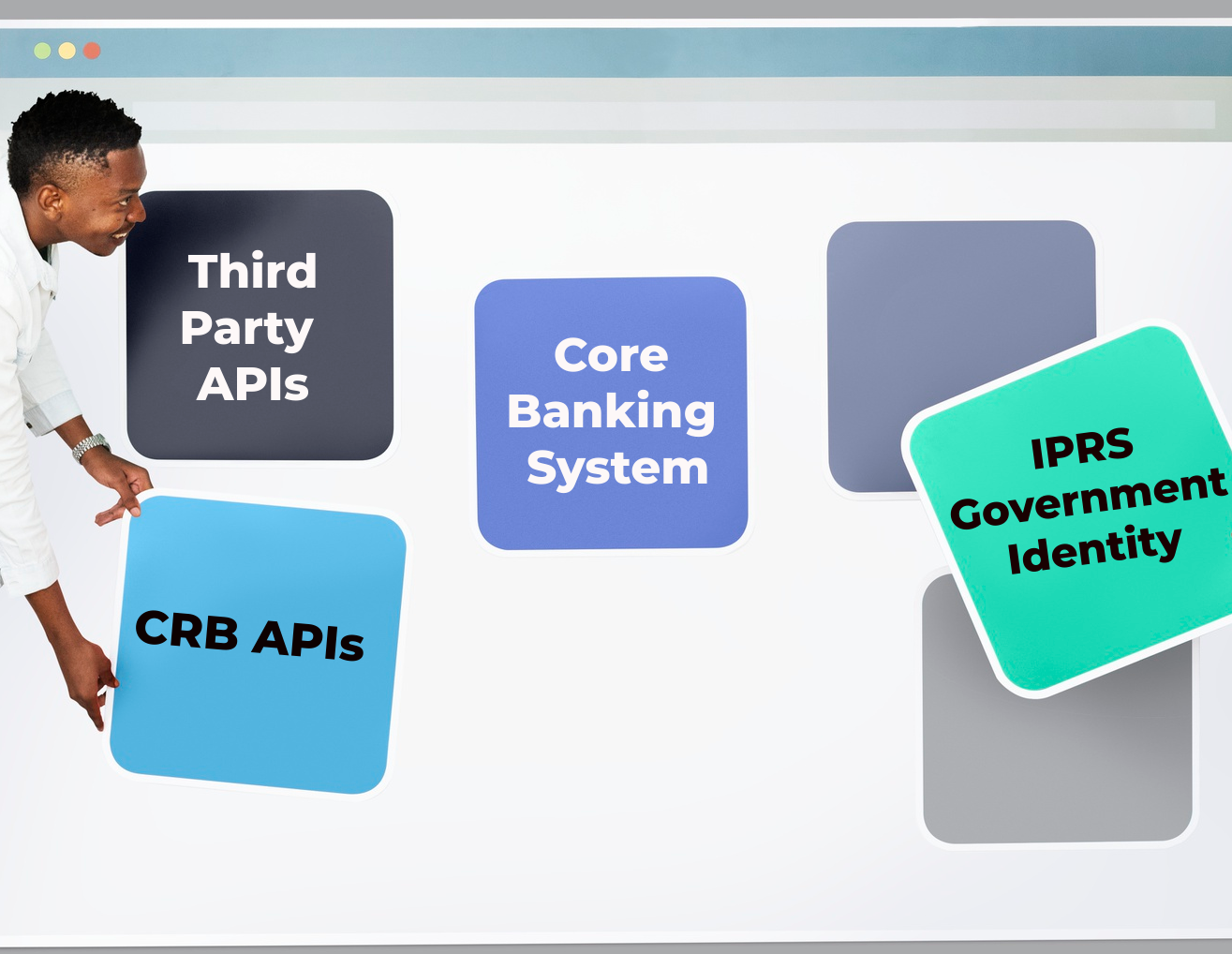

Data Source / Integration

- Core Banking System

- CRB APIs

- IPRS Government Identity

- Third Party APIs

Key Features of Credit Management System

Your modern customers demand transparency, rapid response times, and impeccable service. Credit Management System is the driving force behind elevated customer satisfaction, facilitating faster loan processing and prompt client interactions.

- Cloud Ready

- Highly Scalable

- Open APIs (Integrate to any system)

- Machine learning powered Scoring engine

- Flexible Workflow

- Real-Time Analytics

Unlocking The Benefits of Tera CMS:

- Lower Costs, Improved Efficiency, and Productivity

Empower your institution with advanced self-service tools, optimizing resource allocation and minimizing costs. Tera CMS’s detailed workflows enable swift approvals, reducing turnaround times, and enhancing overall efficiency. - Streamlined Loan Processing

Tera CMS employs state-of-the-art workflow technology that eradicates inefficiencies, accelerates decision-making, and ensures prompt approvals. No more bottlenecks caused by traditional paper-based systems. - Diverse Loan Product Support

Our solution caters to the diverse landscape of loan products spanning various origination channels. Regardless of the loan type, Tera CMS offers structured workflows and tailored processes, ensuring optimized management and processing for each product. - Differentiation and Competitive Presence

Tera CMS enables you to establish a formidable presence in the market while extending a seamless customer experience. - Increased Customer Satisfaction

Tera CMS expedites loan processing, enabling swift responses to client requests. Elevate customer satisfaction through timely actions and transparent processes. - Seamless Integration and Robust Scoring

Tera CMS effortlessly integrates with your existing systems, thanks to its versatile architecture. The solution boasts a robust credit scoring engine, enhancing your institution’s assessment accuracy. Meanwhile, archiving capabilities ensure the safekeeping of essential loan application documents. - End-to-End Loan Origination

Tera CMS seamlessly guides you through the entire loan life cycle. From origination to closure, the system provides a unified platform that simplifies the complexities of credit management. This holistic approach ensures you make consistent and informed decisions at every stage.

Transform Your Loan Management Today!

Dive into the future of credit management with TERA CMS. Streamline processes, enhance efficiency, and elevate customer satisfaction. Don’t let traditional challenges hold you back.

Request demo to experience unparalleled innovation in loan origination and processing.