This document covers how our debt collection system empowers your team to better manage outstanding accounts, automate transaction processes, and ensure compliance with legal and regulatory requirements. Learn how the system improves debt collection efforts, resource utilization, and many more.

Introduction

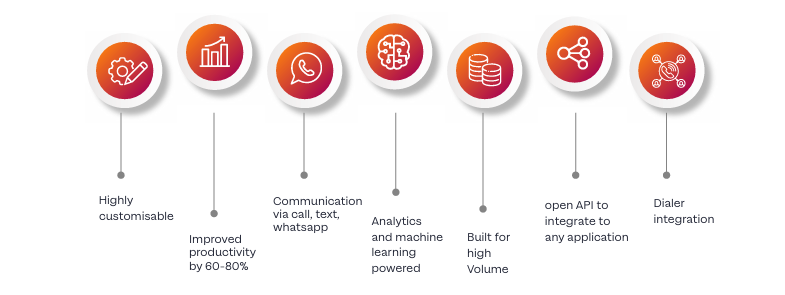

Tera collect is a debt collection software application designed to automate your entire

debt monitoring and collection. The solution is workflow-based and you can customize it to conform to your collection process. Talk of the broad range of tools and features that seamlessly integrates with any core banking system or third party such email, SMS gateway, CRM or external collection agents.

Given highly competitive environment and the ease of switching between banks, your customers leave debts behind them.

The solution enables you to closely manage your customers through intelligent customer segmentation, allowing you to deliver dynamic, tailored collections for each delinquent customer.

With Tera Collect, you can finely segment your customers to create an accurate profile. Moreover, the alerts and timely reports feature enables you to curate and drive the most appropriate strategy.

Process Flow of Debt Collection System

How does Tera Collect work?

-

Tera Collect maintains a real-time connection with your core banking system. All account updates on overdue products occurring in the core are automatically reflected in Tera collect and are assigned to the debt officer within the correct overdue day’s profile rule.

-

The system automatically listens to your loan account events, generates and sends letters/notification to your customers. This is based on preconfigured overdue days and correct overdue balances as in the Core banking system.

-

You can easily amend the content of the letter in case of change. The letter is based on a word document template. Tera Collect consumes this template and auto generates the required information before sending it to your customers via email. In case the customer has no email address, a copy of the generated letter in pdf format is dropped in a pre-configured folder for manual posting of the letter.

-

All customer promises are created based on the overdue product from the credit officer workload. SMS or email reminders are then automatically scheduled and sent a day before the promised date to the customer. In addition, an SMS message is triggered a day(or as defined) after the promised date incase the customer fails to honor the promise made.

-

For an active officer going on leave, he or she can transfer assigned workload to a different officer who will work on collection of his/her assigned accounts when away. Upon the expiration date of the leave date and officer’s resumption to work, the system automatically reverts the workload.

-

The system will hold an inventory of postdated cheques from the customer and will automatically send a reminder report to each officer on assigned accounts for which they are holding the cheques. The reminder is to advice the officer to post the cheques on the banking date instructed by the customer.

-

The officers can also transfer accounts to repossession, collection agents or the legal support. Upon transfer to repossession, the officer can automatically issue reposition orders to a repossession service provider or a release letter to storage yard when the collateral is repossessed, and the customer has paid.

-

Upon account transfers to collection agents the officer can outsource the transferred accounts to collection agent service providers.

-

Upon account transfers to legal support/ department the officer can automatically send the demand letters to customer and initiate the legal recovery process.

-

The system also has a set of report for activities carried out by an officer and events triggered reports based on the real-time changes of the product, overdue amount, or overdue days

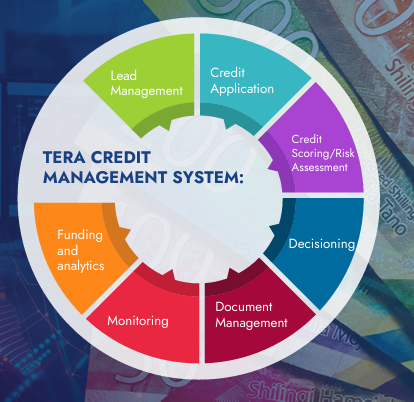

Solution Modules

The system consists of the following prime modules and features

Find Out More About Our Debt Collection System Here