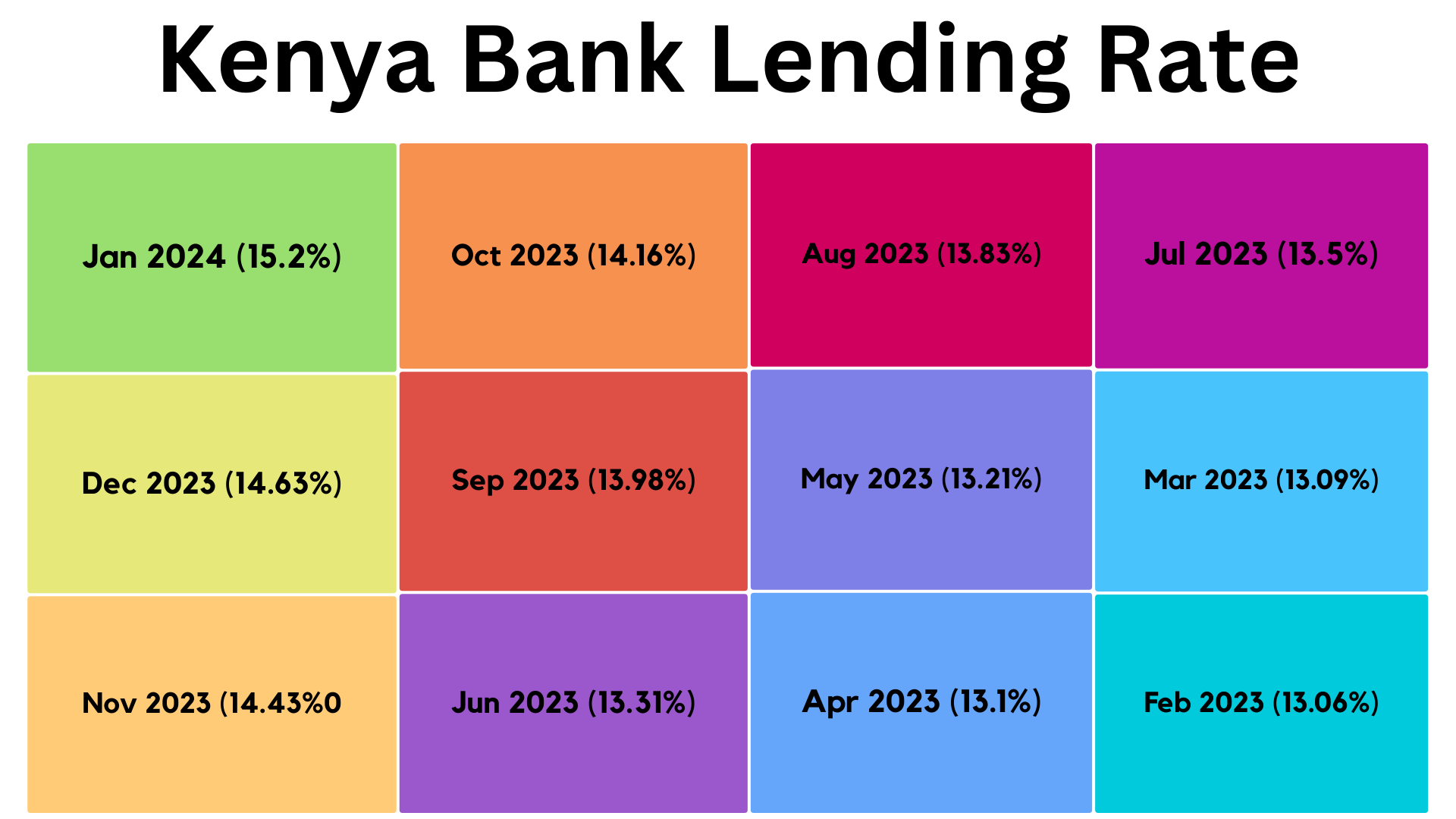

Over the last several months, it seems risk-based pricing has been a hot topic in the Kenyan banking industry. In January 2024, the Central Bank of Kenya (CBK) announced a new bank lending rate of 15.20%, an increase from 14.63% in December 2023. This change in the lending narrative is one amongst many, with implications for both borrowers and lenders.

What’s The Lending Environment Like?

Let’s begin with this assertion in mind;

In the future, all lending will be risk-based.

-Stefan J. Padfield, economist for the Atlanta Fed and author of a paper on “The Rise of Risk-Based Pricing.”

The changing risk-based lending is not just something that will come and go. It’s a continual shift in how lending must be approached, and then executed.

Source: Trading Economics

According to Trending Economics, the lending rate in the country has seen a historical uptick. It goes without a doubt that there has been a steady rise in lending rates from February 2023 to January 2024. The reasons are economic conditions, CBK monetary policy, and lending landscape.

However, it’s not just this recent duration that presents the changing rates. The lending rate has notably fluctuated since 1971, with the average rate being 15.88%. But the worst part is that the rate rose to 32.28% in 1994, the highest ever recorded.

What Does This Mean to You, As a Lender?

Tough times are already here. Times where the monetary policy is becoming tighter. One reason for this could be to curb inflation or stabilize the shilling. As a result, borrowing costs go high, higher or highest in history, just as in the 1994 case.

Ideally, this change in lending dynamics potentially impacts borrowers’ demand for loans and how you assess their creditworthiness. In such instances, the call is on you to adjust your lending rates accordingly, but with a keen consideration of factors, such as risk pricing. Thus, you should understand risk-based pricing and what implications it has on your customers and lending business overall.

So, What is Risk-Based Pricing?

At its core, risk-based pricing is a practice where as a lender, you assess the risk of giving out money/loan to a borrower based on whether they qualify (creditworthiness), plus several factors.

You can also think of it as swiping left to right about your customer, just to ensure that you only lend to borrowers who are likely to pay back. That’s risk-based pricing.

For example:

You can offer a higher interest rate to a particular customer if you view them as a higher-risk borrower. Higher risk borrower in the sense that the person might have been declared bankrupt, lost a job, or is several payments behind on a mortgage.

For the same loan:

You can offer a lower interest rate if you view the customer as a lower risk. Say, if the borrower has a good credit score and is probably employed.

Why is Risk-Based Pricing So Much of a Concern?

Most Kenyan banks have been pushing for the adoption of a risk-based loan pricing model since the CBK removed the rate cap to stop them from repricing their loans. As a result, CBK raised the benchmark interest rate in September 2022, giving 22 of 38 commercial banks in the country the nod to increase their lending rates by 1.1%, effective from November 2022.

And now, the highest loan rate as released by the CBK, is 15.20%.

Also, see disclosures from the Kenya Bankers Association (KBA) on the same.

Although the interest rates charged by the majority of your peer lenders fall within a reasonable range, when other fees are taken into account, the entire cost of acquiring the same loan amount may differ significantly across the industry. To make their products more competitive, however, most lenders are already opting to retain the old interest rates.

Increasing Rates for Those Deemed Risky Borrowers?

Lenders in the industry are increasingly basing lending rates rates on borrower’s credit scores and other factors that they believe are red flags. This means that a borrower with a lower credit score, plus other risk factors, will pay higher interest rates on their loans.

Some borrowers have argued that this new era is unfair, as it penalizes even those who may not have had the opportunity to build up their credit score. Others say it’s simply the market at work—lenders are only trying to minimize the risks on their end. So, they charge more to those who pose a higher risk.

Whatever one’s opinion on the matter, one thing is for sure: risk-based pricing is here to stay with you, and the regulator won’t stop to revise it to meet the changing dynamics.

Criteria and Weight to Determine if Someone is a High or Low Risk

When you assess lending risk, you’re essentially trying to determine the likelihood that a borrower will default on their loan. In that process, you may have to consider several factors that can contribute to this determination, and weight each of these factors differently.

Some common criteria for assessing risk include:

- Credit score: This is perhaps the most important factor in determining lending risk. A low credit score indicates a higher likelihood of default, while a high credit score implies a lower risk.

- Employment history: Borrowers with a steady employment history are typically seen as less risky than those who have been unemployed for long periods or who have frequent job changes.

- Debt-to-income ratio: This criterion measures how much of a borrower’s income is being sliced to pay off debts. A high debt-to-income ratio indicates that the borrower may have difficulty making their loan payments, and is, therefore, considered riskier.

- Asset value: A borrower with more assets typically pose less risk than one without any asset. This is because you may use the assets to recover the loan if the borrower defaults.

Generally:

Being a lender puts you in a non-negotiable position to use some or a combination of the above criteria to determine creditworthiness. However, the specific criteria and weighting may vary based on the dynamics.

How To Ensure Accurate Credit Risk Assessment

It’s no secret that as a financial institution, you’re under pressure to improve your lending practices. But that’s not what is happening now. So absent in your lending practices is a clear, digital path to determine risks.

You could be doing it manually, which has proven to be a dead end, and you don’t want to be caught up with unexplainable higher Non-Performing Loans.

There are indisputable reasons to believe that a credit scoring model is the future of accurate assessment of creditworthiness:

- It’s a better way to be certain of how likely a loan applicant is to repay a loan.

- Information obtained from risk analysis can be used to set interest rates that reflect the risk involved in lending to each borrower.

- Easy to automate the process of setting prices, which can save time and improve efficiency.

- Easy to identify patterns and trends that may not be apparent using traditional methods.

- Monitoring customer behavior in real time helps to quickly identify and respond to changes in risk levels.

- Credit scoring provides your customers with more transparency about how their data is used.

- A smarter, more sophisticated credit scoring model can be enhanced to comply with evolving government regulations. This greatly favors borrower protection.

- Low-risk borrowers can get lower interest rates. High-risk borrowers may get approved for a loan that they would have otherwise been denied.

This form of credit scoring is unique to your customer’s borrowing and loan repayment discipline. The system enables you to reward your customers with increased access to credit and predictable repayment plans. It takes into account many factors, all of which lead to more accurate pricing and better lending decisions.

Transform Your Lending Practices Today with The NLS Credit Scoring System

Contact us today to learn how our credit scoring system can empower your credit department to make accurate decisions when lending.