Customers are often attracted to financial institutions that don’t overlook what matters – customer experience. That is especially true when they are seeking loans from your institution. You may lose them faster than you can say ‘sorry’ if your loan approval process takes days or weeks instead of just hours when done right.

10x Banking found that 1 out of every 8 banking professionals worldwide have confirmed losing up to 40% of their clients because of poor customer service.

The report that also sampled over 150 key decision-makers from different global industries (Africa, The United Kingdom, Australia, Vietnam, Germany and India) found that 64% of them agree that digital transformation decisions affect customer retention.

The Above Report Evidences Two Key Things:

- Every financial institution, large or small-tiered, must improve how it delivers services if it wants to retain those customers.

- They must also adopt new technologies to improve service delivery and keep their customers loyal and happy.

As a credit department, you know what it means when just a handful of customers are knocking on your door. If you’re not intelligent enough, you might begin thinking all is well. Your customers are simply telling you that:

We don’t have trust in your lending process. It is so frustrating. You demand too many documents and you take too long to approve loans.

The main reason for such dissatisfaction lies in your loan approval process. The process could be having multiple, tiresome steps, which only lead to more and more delays.

Yet what your customers need is simple:

Think about solving our problems in a way that makes our lives easier.

This is a good thing for both of you to build loyalty.

This whole Thing is a Test of Speed and Efficiency

It tells how long you take to process loan applications, approve them, and release the money to the borrowers.

Reducing that time requires you to speed up your entire loaning process. This reduction in time is crucial for your customers, the credit team, and the entire financial institution.

Sages Where Things Can Slow Down in Loan Approval

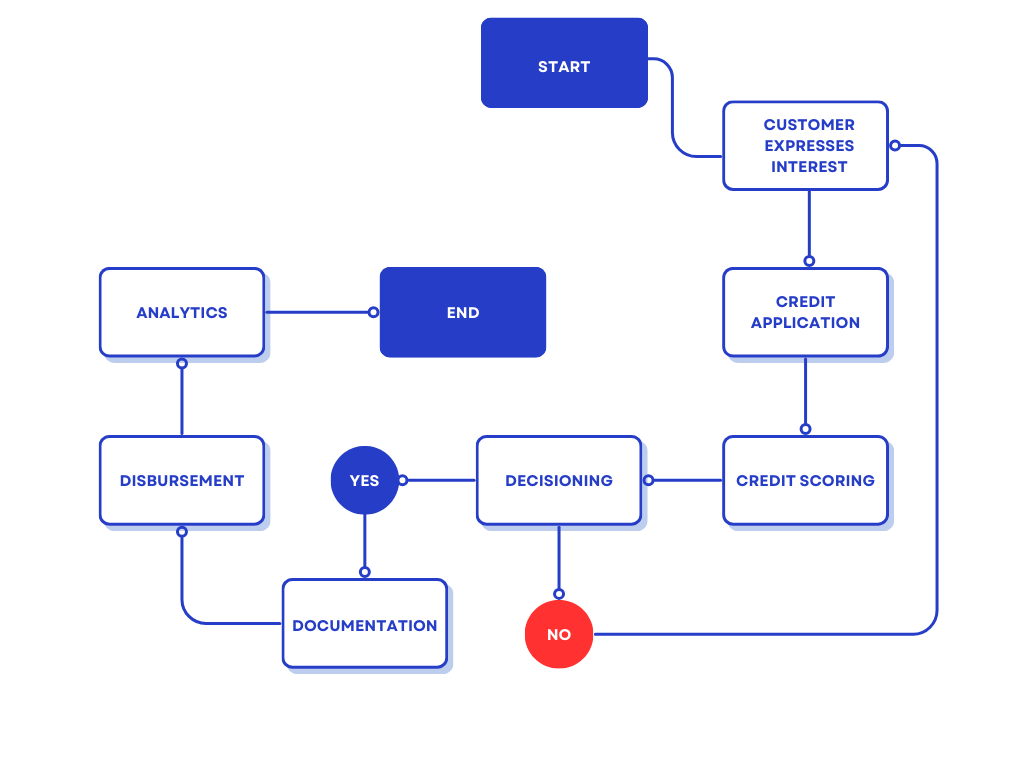

A typical loan approval process involves the following key steps:

Here is a detailed view of the above critical steps:

Here is a detailed view of the above critical steps:

i. Lead Management

This stage is where your potential customers express their interest in taking a loan from your institution. What follows is the gathering of basic information from them to start the process.

ii. Credit Application

The borrowers formally submit their loan applications detailing information about themselves and the reason (s) for borrowing.

iii. Credit Scoring/Risk Assessment

You evaluate whether a particular borrower qualifies to be awarded the requested loan. This verification is based on the borrower’s income level, credit history, debts, or other key financial indicators.

Ideally, you are trying to determine the risk of giving out the money to that borrower.

iv. Decisioning

The risk assessment report helps you to decide whether to say YES or NO to the loan application. It also determines whether you can request further information about the borrower to make better informed decisions.

v. Document Management

At this stage, you gather all the required customer documents (tax returns, income statements, legal disclosures, etc.) and ascertain.

vi. Disbursement

If approved, you disburse the money to the borrower through the appropriate channel.

vii. Analytics

This is where you now analyze data from the entire process. The intention is to help you manage risks, improve your lending process, and make more informed decisions in the future.

These processes are critical. The borrower must go through the entire screening stages to enable you to determine their likelihood of repayment and calculate the loan interest rate and terms.

What Causes Delayed Loan Approvals?

Several factors can be at play, depending on a particular loan or customer:

- Incomplete Information: Some customers may submit incomplete/inaccurate information while applying for a loan. Such incomplete applications may prolong the approval process since you still need to collect additional information to complete the process.

- High Volume of Applications: Volumes of applications mean there could be delays in processing them, especially when the process is manual.

- Manual Loan Processing: when done manually, reviewing loan applications can be time-consuming. However, a simplified process makes it faster.

- Credit Scoring Issues: Low credit scores or previous delinquencies may require additional scrutiny, which contributes to an even longer approval time.

- Regulatory Requirements: Being under the regulator’s watch means you must comply with some requirements and internal policies. This compliance can lengthen the approval process, especially when dealing with loan applications involving higher risk or huge sums.

- Communication Issues: The approval time can also lengthen due to poor communication with your customers. Moreover, customers may delay responding to your requests for information.

Properly addressing these issues can help you reduce delays and speed up the process.

Speed Matters A Lot in Loan Approval

When you approve loans faster, you are saving your customers a lot of time, and even encouraging them to pay back fast. They are even likely to refer others to your institution. However, when your process is too low and complex, the same customers might decide to seek loans elsewhere.

But Speed is Nothing Without technology

Speeding up the processing and approval of loans is only possible with technology, precisely, automation.

Since consumer behaviors are unpredictable, you might want to consider changing your way of doing things before it’s too late. And the only way is automation.

That’s All Excellent. What Can NLS Do?

NLS has been customizing their Credit Management System (TERA CMS) to several financial institutions for quite some time now (10+ years).

The most essential feature of Tera CMS is its Loan Application Processing Workflow.

Here’s a quick overview of what the system offers:

- an end-to-end approach to loan origination

- a structured workflow.

- room for multiple loan products with different origination channels.

- easily integrates with other existing systems

- a robust credit scoring engine and archiving for various loan application-related documents.

- credit scores from third party scoring agencies

- credit scores parametrised (originators input credit scores, and the system determines the ratings).

With that said, take the step to bring several lending benefits to your bank, Sacco or microfinance institution .

Make Faster Decisions When it Comes to Loan Applications.

Let’s chat.