Large Enterprises and Corporates face a serious challenge of making seamless, real-time, and cost-effective transfers between banks and their corporate clients. Host-to-host streamlines such financial operations, impacting the ability to manage finances effectively.

What’s in Store

- The Challenge: Complex Financial Operations

- Enter Host-to-Host Connectivity for Financial Excellence

- What is Host-to-Host Connectivity?

- Who’s a Corporate Client for A Bank?

- How Host-to-Host Connectivity Works

- Key Features and Components of Host-to-Host Corporate Connect Solution

- Benefits of Implementing Host-to-Host in Your Financial Institution

- The Bottom Line

The Challenge: Complex Financial Operations

Consider a multinational supermarket with operations spanning the globe. This conglomerate juggles numerous financial transactions daily, including payroll processing, supplier payments, internal fund transfers, writing checks, keeping track of invoices, and more. With multiple subsidiaries, each operating in different regions and currencies, there’s a high volume of transactions and manually managing these financial operations becomes a Herculean task.

Late payments can also strain supplier relationships, disrupt the supply chain, and even result in lost sales opportunities. Inaccuracies, human errors, and time-consuming paperwork further exacerbate the challenge, potentially harming the supermarket’s reputation and profitability.

Here are the Challenges in a Nutshell:

- Inefficiency

Manual financial processes are time-consuming and prone to errors, leading to delays and discrepancies in payments, and potentially affecting relationships with suppliers, employees, and clients.

- Inaccuracy

Managing a multitude of financial transactions manually increases the likelihood of errors, which can result in financial losses, compliance issues, and reputation damage.

- Lack of Visibility

With operations dispersed globally, the corporation lacks real-time visibility into its financial position, making it challenging to make informed decisions and optimize cash flow.

- Compliance Risks

Operating in multiple jurisdictions means navigating complex regulatory landscapes. Failure to comply with financial regulations can result in fines and legal complications.

- Security Concerns

Traditional, manual financial processes may not provide the level of security needed to protect sensitive financial data from cyber threats.

Host-to-Host Connectivity for Financial Excellence

Host-to-host connectivity has become a cornerstone of modern banking and financial services. It enables seamless integration between different banking systems, corporate clients, and financial partners. Banks and financial institutions use H2H Connectivity to automate various processes, including payments, fund transfers, reconciliation, reporting, etc., thereby enhancing efficiency, accuracy, and security in the financial ecosystem.

What is Host-to-Host Connectivity?

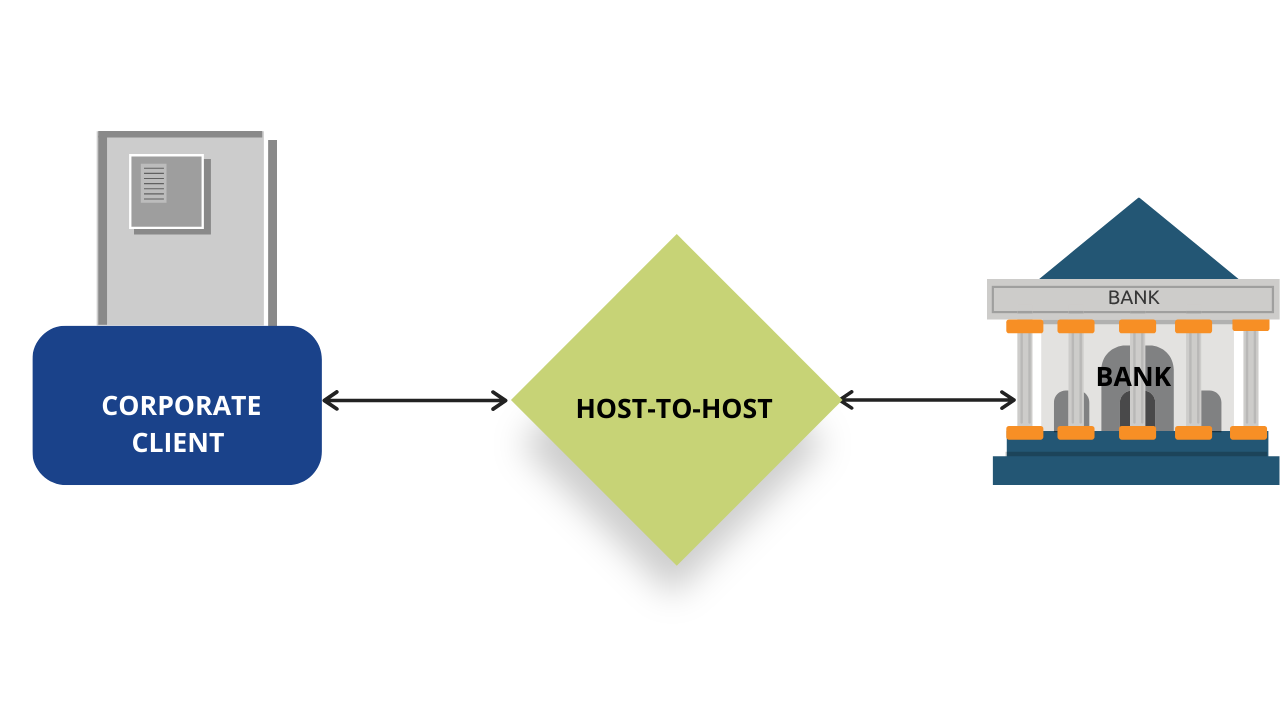

Host-to-host Connectivity (H2H) refers to a direct and secure electronic connection between a bank’s system and its corporate customers. Unlike traditional methods such as manual data entry or file transfers, this solution allows for real-time and automated transfer of financial information. It eliminates the need for intermediaries and ensures data integrity and confidentiality throughout the process.

Host-to-host Connectivity (H2H) refers to a direct and secure electronic connection between a bank’s system and its corporate customers. Unlike traditional methods such as manual data entry or file transfers, this solution allows for real-time and automated transfer of financial information. It eliminates the need for intermediaries and ensures data integrity and confidentiality throughout the process.

Who’s A Corporate Client for A Bank?

A corporate client is a big business or company that uses your bank’s services for its financial needs. These businesses are usually larger and more complex than regular individuals or small businesses.

Corporate clients rely on your bank for various financial services:

- managing their accounts

- making large transactions

- getting loans for business expansion

- accounts reconciliation

- receiving financial advice, etc.

Your bank offers specialized services and support to corporate clients to help them manage their finances effectively and achieve their business goals.

How Host-to-Host Connectivity Works

Take the case of a supermarket that needs to pay its suppliers electronically. The supermarket has a bank account with Bank X, and both the supermarket and the Bank use a Host-to-Host Corporate Connect Solution for this purpose.

- Corporate Client (Supermarket):

The supermarket has its computer systems, for instance, where they manage their finances. They want to pay their suppliers directly from their bank account, which means they need a secure and automated way to do this without manual paperwork.

- Host-to-Host System:

The H2H system acts like a bridge between the supermarket and your bank. It’s like a specialized computer program that can talk to both the supermarket’s systems and your bank’s systems.

- Bank X: (Your Bank)

Your bank holds the supermarket’s money and manages financial transactions. It offers an H2H connection to allow this corporate client to interact with its banking services directly from their systems.

How it Works:

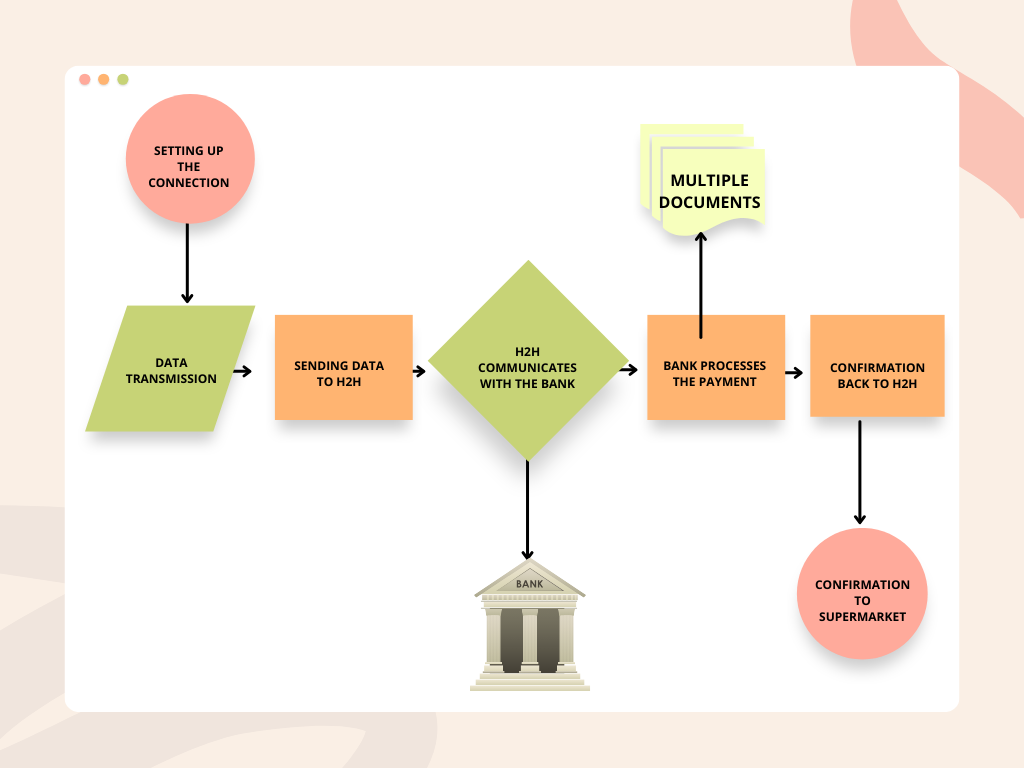

1. Setting Up the Connection:

-

- The supermarket and the bank work together to set up the Host-to-Host connection. The two agree on how data will be sent, received, and secured.

2. Data Transmission:

-

- The supermarket enters payment information (like the amount, supplier details, and payment date) into its systems.

3. Sending Data to Host-to-Host:

-

- The supermarket’s system sends this payment information to the Host-to-Host system.

4. Host-to-Host Communicates with Bank:

-

- The Host-to-Host system takes the payment data and securely communicates it to the bank’s systems.

5. Bank Processes the Payment:

-

- The bank receives the payment request, verifies it, and processes the payment to the supplier on behalf of the supermarket.

6. Confirmation Back to Host-to-Host:

-

- The bank sends a confirmation message back to the Host-to-Host system, indicating that the payment has been successfully processed.

7. Confirmation to Supermarket:

-

- The Host-to-Host system forwards this confirmation to the supermarket, so they know that the payment has been made.

Key Points:

- The Host-to-Host system acts as a middleman, ensuring that data is securely transmitted between the supermarket and you as an institution.

- The supermarket doesn’t need to manually log in to your website or visit your branch physically; they can manage their payments from their systems.

- This process is not just for payments; it can also be used for other financial transactions, like checking account balances or transferring money between accounts.

In simple terms, Host-to-Host Corporate Connect Solution makes it easy for your corporate clients to handle their financial tasks electronically, without the need for lots of paperwork or manual work. It’s like a special messenger that securely carries financial messages between the business and you, making transactions faster and more efficient.

Enhancing Business Efficiency with H2H Connectivity at Faulu Microfinance Bank

Faulu understands the need to provide seamless payment solutions to its corporate clients. To meet this demand, Faulu has introduced a Payment Gateway, a powerful Host-to-Host (H2H) API integration solution that enables it to streamline its payment processes.

Faulu Has Streamlined Payments with Host-to-Host Integration

The Faulu H2H is designed to facilitate straight-through processing (STP) of payments directly from their customers’ Enterprise Resource Planning (ERP) systems.

i. Secure API Integration:

- Faulu’s H2H API integration is established through a secure Virtual Private Network (VPN) link or point-to-point integration. This ensures the confidentiality and integrity of data during transmission.

ii. Effortless Payment Origination:

- With this integration, authorized teams within Faulu’s customer organizations can effortlessly originate payment files directly from their ERP systems.

iii. Automated Processing:

- The Faulu Payment Gateway is designed to eliminate manual intervention. It efficiently handles authentication, authorization, payment processing, and even auto-reversals, streamlining the entire payment workflow.

iv. Seamless Return File Handling:

- After processing, Faulu Bank generates a return file in an acceptable format. This return file is sent back to the customer’s ERP system, facilitating auto reconciliation. This means that businesses can easily match their records without the need for time-consuming manual efforts.

v. Versatile Payment Handling:

- Faulu Payment Gateway is a versatile solution that securely executes payment instructions from various channels. It receives payment instructions, transforms them as per the requirements of the payment service provider, and sends them for processing.

Key Features and Components of Host-to-Host

H2H offers your team a range of key features and components that contribute to your financial institution’s effectiveness:

1. Direct Connection

This solution allows for direct connection between systems, eliminating the need for intermediaries or third-party platforms. This direct connection minimizes latency and ensures the integrity and confidentiality of data.

2. Secure Data Transmission

H2H prioritizes data security through robust encryption techniques. Encryption in the sense that every piece of data that leaves your bank to the client is protected. This ensures that the sensitive information you exchange remains protected throughout the transmission process, mitigating the risk of unauthorized access.

3. Scalability

You can scale up your business connectivity needs as your clients’ operations expand, thanks to the scalability inherent in H2H. It accommodates the changing demands of your growing corporate clients, ensuring seamless connectivity even during periods of rapid expansion.

4. Real-Time Data Exchange

This solution enables real-time data exchange between your systems, applications, and even devices. It ensures that all stakeholders have access to the most up-to-date information, facilitating informed decision-making and improving overall operational efficiency.

5. Integration with Existing Systems

H2H is designed to seamlessly integrate with your existing systems, applications, and infrastructure. This compatibility allows your banking businesses to leverage your current technology investments while enhancing connectivity.

Benefits of Host-to-Host in Your Financial Institution

Host-to-host connectivity is a transformative solution for corporations facing complex financial challenges. Here’s how H2H Connectivity addresses this corporate conundrum:

i. Enhanced Efficiency and Automation in Financial Transactions

Gone are the days of manual entry and lengthy processing times for financial transactions. With host-to-host connectivity, you can offer your clients an automated platform that simplifies the entire transaction process for them. From initiating payments to receiving and reconciling them, everything is done swiftly and accurately. This results in improved operational efficiency and a significant reduction in errors.

ii. Reduced Processing Time and Cost Savings

Time is money, and H2H in your institution understands this well. By eliminating manual intervention and using automated processes, you are drastically reducing transaction processing time. This means faster fund transfers, improved cash flow management, and enhanced liquidity for your corporate clients.

iii. Secure Data Transmission

When it comes to financial transactions, security is paramount. H2H connectivity ensures the highest level of data protection through secure transmission channels and robust encryption protocols. This minimizes the risk of data breaches and unauthorized access, providing you and your team peace of mind, as well as your corporate clients.

iv. Minimizing Fraud and Unauthorized Access in Banking Operations

Fraud is a growing concern in the financial services industry, but H2H connectivity helps mitigate this risk. A direct connectivity, you can implement stringent authentication measures and authorization processes, reducing the likelihood of fraudulent activities. This safeguard enhances the overall security posture of banking operations and strengthens trust between you and your corporate customers.

v. Real-time Financial Insights

With H2H Connectivity, your corporate clients gain real-time visibility into their financial data across subsidiaries and regions. This empowers them to make informed financial decisions and optimize cash flow.

vi. Compliance Assurance

H2H Corporate Connect solution can be configured to comply with specific financial regulations in different regions, mitigating compliance risks.

The Bottom Line

H2H isn’t just about solving a problem; you’re empowering your corporate clients to thrive in today’s competitive global markets.

By partnering with experienced solution providers and following a well-defined implementation process, you can unlock the full potential of seamless connectivity and adapt to the demands of a rapidly evolving business landscape.

Explore the Power of Host-to-Host?

Our experts will be happy to advise you.